Equities Portfolio Cost: S$684, 447

Equities Portfolio Market Value: S$1,048,180

Equities Portfolio Unrealised Profit: +S$363, 733 (+53.1%)

Portfolio XIRR (FY2025): +22.9% (inclusive of dividends)

Dividends Collected (FY2025): S$46, 089 (+6.5% yoy)

Total Cumulative Dividends (2010 - 2025): S$371, 015

Current Cash & Cash Equivalents: S$23, 000

(*All figures are accurate as of 31 Dec 2025)

- Subscribed to Keppel DC REIT preferential offering

- Accumulated PropNex at S$1.87

- Accumulated Amazon at US$221

- Accumulated Alphabet at US$298 and US$306

- Accumulated Microsoft at US$477

- Accumulated Nvidia at US$179

Multi-Year Heavy Bets Paid Off Handsomely

2025 was a great year in terms of investment returns. All the counters in my portfolio ended the year in the green except three losers. My top five winners in 2025 (excluding dividends) were PropNex (+102%), Alphabet (+66%), Sheng Siong (+59%), DBS (+29%) and CapitaLand Integrated Commercial Trust (+21%). My bottom three losers (excluding dividends) were Mapletree Industrial Trust (-9%), UOB (-4%) and Keppel DC REIT (flat). In terms of total dividend payout, a record-high of $46k was achieved largely thanks to hefty special dividends from the three local banks and PropNex.

My thesis on Sheng Siong and PropNex finally paid off big in 2025. I built up significant positions on both counters through constant, steadfast accumulation since 2023. I even did one last aggressive buy when the Trump Tariffs correction hit in April. The massive tailwind finally arrived in May 2025 after the incumbent government clinched a strong mandate during the General Election. Both PropNex and Sheng Siong stand to benefit long-term from government policies (which I mentioned in previous posts). In the second half of the year, both counters kept breaking new highs. Although recently, PropNex had retraced back to S$1.90, it still ended up as my top performer for the year.

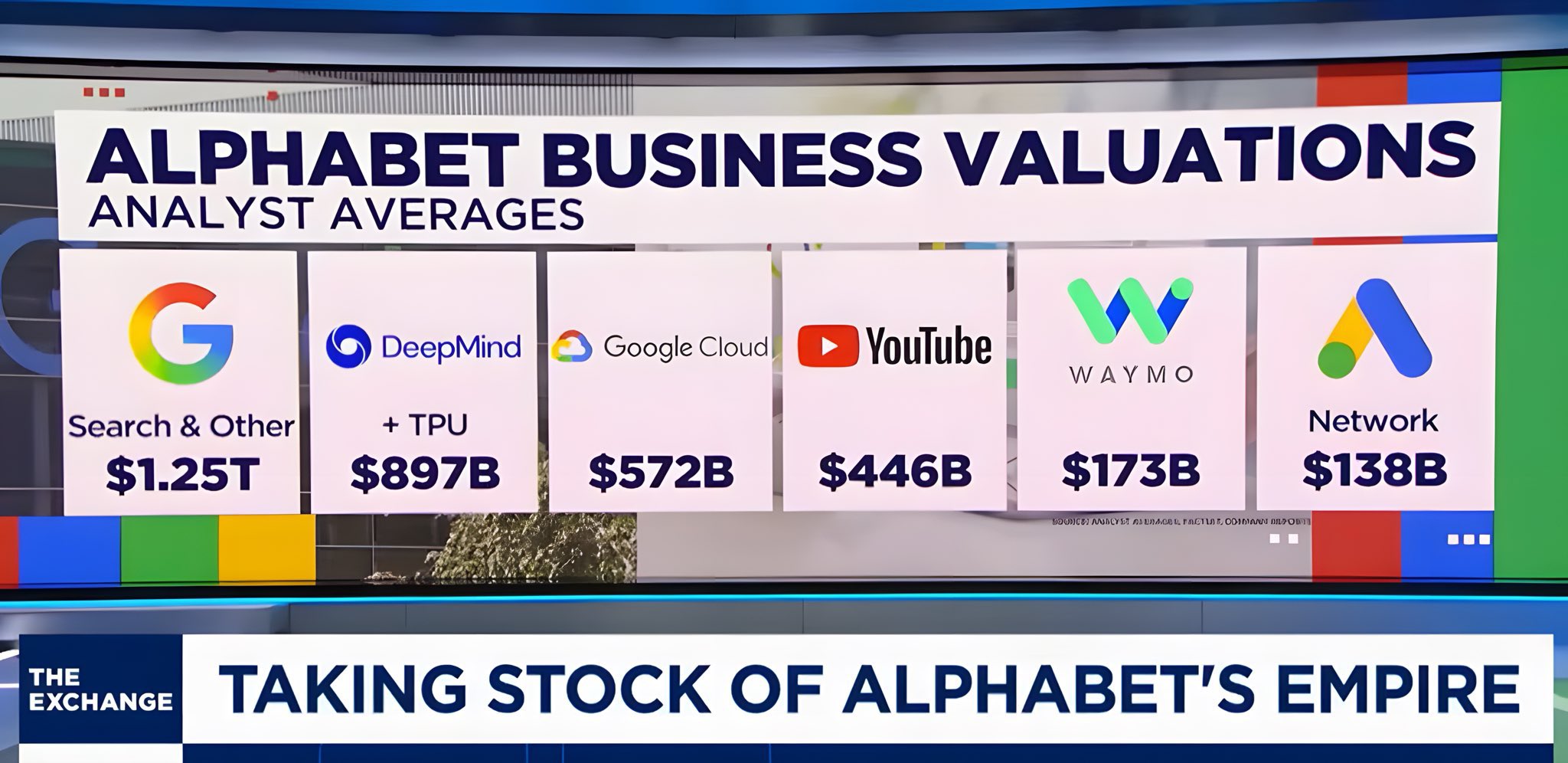

Next, my thesis on Alphabet also yielded huge returns in 2025. It is my current top US position by far. I always thought the narrative around the death of Google Search was overblown. Too much doom and gloom. Again, bought aggressively back in Q2 2025. YouTube is bigger than Netflix and still growing. Google Cloud posting robust year-on-year growth. Android OS deeply entrenched on all smartphones outside of Apple's iPhone. Waymo is expanding its robotaxi service into new markets. One of the major shareholders of SpaceX. I also bet on a favourable verdict from its anti-trust case, which did came true. The emergence of OpenAI actually helped to prove Alphabet's argument that its search business is not a monopoly because ChatGPT is a rival. In the end, the US Department of Justice did not require Alphabet to break up and sell off Chrome. So, Alphabet's eco-system moat remains intact. It owns an entire integrated AI stack. Furthermore, I am confident that Google's AI model will eventually catch up to ChatGPT and that came true too. Google Gemini 3 AI model is pretty much on par with ChatGPT 5 right now. I have started incorporating Gemini into my daily life and it works fine. Not to mention how insanely useful Google Maps and Translate proved to be during my trips to Tokyo, Osaka and Bangkok.

First-ever Trip to Osaka

My gradual transition from wealth accumulation to enjoying my fruits of labour continued with my recent trip to Osaka. Putting some of my dividends to good use. Improving my quality of life bit by bit. For now, I aim to travel to two places per year. Eventually, I plan to visit four destinations per year. Secondly, I also look to upgrade at least one thing I use regularly in my life every year. This year, I upgraded from regualr iPhone 15 to an iPhone 17 Pro. I had a great time using it to navigate, take photos and film videos on my Osaka trip.

.png)

.png)

.png)

.png)

.png)