|

| (Total cumulative dividends: S$263, 709) |

Portfolio Cost: S$556, 740

Portfolio Market Value: S$713, 536

Portfolio Overall Unrealized Profit: +S$156, 796 (+28.16%)

Portfolio XIRR (1H 2023): -3.7% (inclusive of dividends)

Dividends Collected (1H 2023): S$22, 203 (+35.1% yoy)

Total Cumulative Dividends (2010 - 1H 2023): S$263, 709

Current Cash Warchest: S$21, 470

(*All figures are accurate as of 30 June 2023)

Portfolio Actions in Q2 2023:

- Full divestment of Nvidia at +37.8% gain

- Full divestment of Microsoft at +27.1% gain

- Full divestment of TSMC at +7.6% gain

- Partial small divestment of Propnex at +359.7%

- Accumulated more OCBC at S$12.35

- Accumulated more UOB at S$27.90

- Accumulated more ParkwayLife REIT at S$3.73

- Accumulated more Frasers CentrePoint Trust at S$2.18

A.I. Driven Rally & Bumper Dividends from banks in Q2

Thanks largely to significantly higher dividend payouts from the three local banks in Q2, total dividends collected in 1H2023 has increased 35.1% yoy compared to 1H2022. The Artificial Intelligence (AI) mania has taken the US markets by storm, pushing big tech stocks to new all-time highs. Yeah, so much for all the talk about a deep recession. Anyone still remember the Silicon Valley Bank & Credit Suisse crisis? Seems like Jerome Powell is going to get his wish of a 'soft landing' for the US economy. I took this opportunity to fully divest my very minor positions in Nvidia, Microsoft and TSMC, which take up 4% of my overall portfolio. I am left with Apple, Tesla, Alibaba and AMD as my current tech holdings. The divestment proceeds were then re-invested in solid banks & REITs as their prices dipped in June. You guys know me. BTFD is my preferred style. Before this latest rebalancing exercise, DBS was my top banking position by far. Now, OCBC is my largest banking position, followed by DBS and UOB. Let's take a closer look at OCBC.

OCBC's Potential For Higher Dividends & Latest Strategic Refresh

OCBC's aim to bring its CET1 ratio towards 14% in the short to medium-term translates into roughly S$4.4b of excess capital. So, the bank can potentially raise its dividend payout in the coming years. If OCBC maintains its current dividend payout ratio of 50%, it is poised to be the highest yielding bank compared to DBS and UOB.

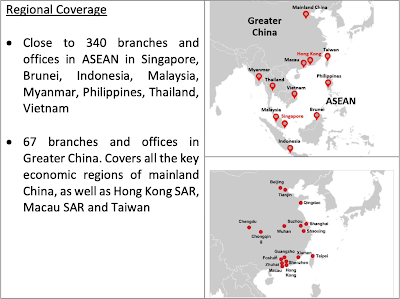

Auntie Helen and her executive team have been busy. OCBC aims to deliver S$3b in total incremental revenue by 2025, through a focused push into ASEAN-Greater China region. More than S$50m will be invested to build up capabilities in the Greater China market.

- Aims to double the AUM of its Premier Banking and Premier Private Client segments in Greater China. The number of relationship managers serving high net-worth customers will double by 2025.

- Bank of Singapore (OCBC's private banking subsidiary) aims to increase its AUM to US$145b by end-2025.

- Expand its coverage of SMEs in Hong Kong. Aims to onboard 26, 000 new SMEs over the next 3 years.

As I get older, I start to appreciate the value of stealth wealth. Don't be flashy. Don't flaunt. Spend within my means. My spending philosophy is to go for long-term value. Just because you can afford something expensive doesn't mean you have to buy it. You need to evaluate if that Chanel, Gucci, Prada, LV or Hermes handbag actually add long-term value to your life or is it going to collect dust on the shelf. If I use something on a regular basis, I am willing to pay more for better quality. Example, a comfy pair of sneakers, firm bed mattress, premium laptop, quality food etc. My two cents worth on personal budgeting. Never spend everything like it is your last day on Earth. Don’t save everything and forget to live. Balance is key!