|

| (Total cumulative dividends = S$223, 208) |

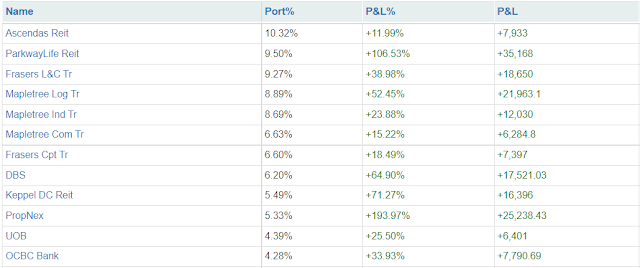

Portfolio Cost: S$552, 309

Portfolio Market Value: S$717, 725

Portfolio Overall Unrealized Profit: +S$165, 416 (+29.9%)

Portfolio XIRR (Q2 2022): -11.43%

Portfolio Year-to-date Returns: -5.9%

Dividends Collected (Q2 2022): S$10, 980

Total Cumulative Dividends (2010-2022): S$223, 208

Current Cash Warchest: S$33, 700

(*All figures are accurate as of 30 Jun 2022)

Portfolio Actions in Q2 2022:

- Accumulated more Ascendas REIT at S$2.73

- Accumulated more CapitaLand China Trust at S$1.15

- Accumulated more Mapletree Logistics Trust at S$1.61

- Accumulated more TSMC at US$88

- Initiated position on Nvidia at US$187

Taming The Inflation Monster

Global markets have been brutal in Q2 2022. Oil price shot above US$100. Countries started banning exports of resources like wheat, palm oil and chickens. Inflation rates in developed nations hit record highs in decades! According to the experts, we should expect an extended period of high inflation. This is bad. Inflation 'robs' everyone except maybe the uber rich. Oh, and to make matters worse, here in Singapore, we are set to raise GST next year. In Q2, the US Federal Reserve was desperately trying to tame this inflation monster without causing a full-blown recession. Engineering a 'soft landing' is easier said than done. I reckon the US fed would probably swing the pendulum too far into the other side. So guys, buckle up and hunker down. Be prepared for more pain ahead.

Hope For The Best, Plan For The Worst

The best case scenario is the US Fed rate hikes working effectively in bringing down inflation gradually by the end of 2022. But we all know things rarely work out the way we want them to. These are things I have been doing to better prepare financially for an inflationary future. Obviously, I can only speak for myself. Everyone's financial situation is unique. There is no one-size-fits-all solution. So you lot need to make adjustments yourselves.

First, try to stay employed! Get that regular paycheck. I am saving up most of my mid-year bonus. This might sound counter-intuitive since high inflation is going to erode the cash value. Don't get me wrong. I am not saying we should hoard a mountain of cash. But we do need to keep a healthy amount to pay for higher living expenses. Cash is like oxygen. You don't really notice it, until you really need it. And for those home buyers with a mortgage loan burden on their shoulders, hang on to your jobs for dear life! Banks are likely to keep raising home loan rates over the next couple of months.

Second, I am buying the 'deeper' dips. Buy in batches, with wider margins in between batches. I noticed these 'deeper' dips in the markets tend to occur after the US release their monthly CPI figures. This pattern could repeat in 2H 2022. Plan your watchlist and get ready for more buying opportunities.

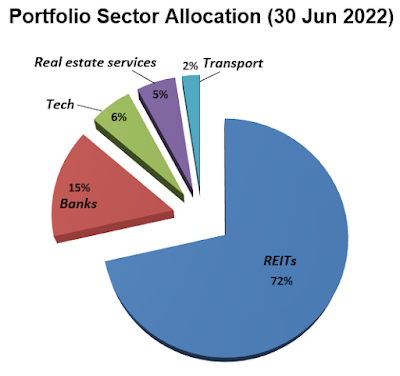

Third, focus on quality top-tier companies with strong balance sheets and pricing power. Avoid companies with high capex and operational costs. Buy the winners. Buy the leaders. I am going for blue-chip banks, REITs and tech.

And while we are on the subject of 'quality'. I feel we should focus our personal spending on stuff that add value to our lives consistently. For example, I go for runs at least thrice a week. So I decided to invest in a pair of Nike running shoes. All of us got to eat everyday right? So, food is another thing I would go for quality. Tasty food is absolutely worth it! Live a little! ^^

You create your own calm

Dividend Warrior

No comments:

Post a Comment