*An increase of 26% compared to 2Q2018 passive income

No Need For Panic Over MLT

MLT was aware of the financial difficulties facing CWT's parent before they acquired the properties, so 6-month rental security deposits have been collected. CWT has not defaulted on its rental payments to MLT so far. It is still business as usual for CWT Pte Ltd (CWTPL). Due to the high-quality and well-located properties, coupled with Mapletree's connections & wide network in the regional logistics industry, MLT should be able to find replacement tenants within half a year. About 30% of the leases to CWT are sub-let to third-party end-users under sub-lease agreements. If CWT goes bust, MLT will take over these sub-leases directly. For the remaining 70% of leases, MLT can refer the end-users to other third-party logistics (3PL) providers, which could take over the leases. In fact, MLT has received queries from other 3PL providers expressing an interest to take over CWTPL’s operations if available.

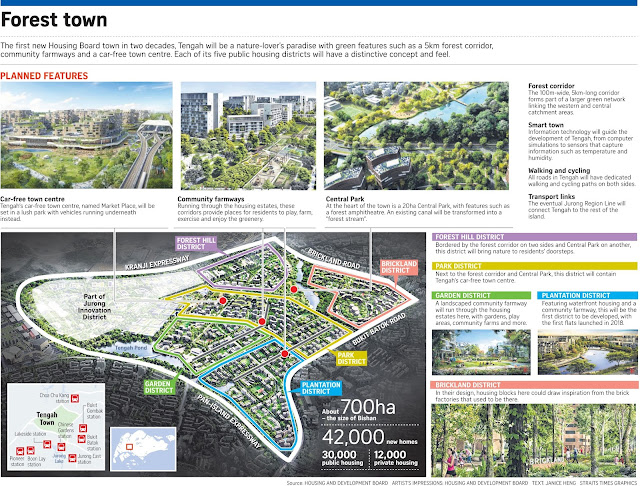

Long-Term Tailwind For MCT

Back in March, URA launched its Draft Master Plan 2019 for the Greater Southern Waterfront (GSW). MCT owns two properties in the vicinity, VivoCity mall and Mapletree Business City I (MBC I). These two 'crown jewel' properties should enjoy an uplift in valuations over the long run.

Some of the redevelopments along the GSW area are likely to start within the next 5 to 10 years. The increase in commercial activities with a larger catchment population in Pasir Panjang could drive future rental growth at VivoCity and MBC I. If MCT ever launch a rights issue to fund a DPU-accretive acquisition of MBC II, I would be more than happy to subscribe for excess.

Staying Vested In Frasers Logistics & Industrial Trust (FLT)

Despite a slight dip in its quarterly DPU, the fundamentals of FLT did not weaken. The weaker DPU is mainly attributed to the fluctuations of foreign exchange rate between the $AUD and $SGD. Currency risk is one of the expected risks when I decided to invest in FLT and my entry price near its NAV allows me to continue holding it for a yield above 7%. There is no overwhelmingly better alternative being offered in the markets right now. Besides, I am already vested in AREIT, MLT & MINT. In my opinion, there are no better substitutes out there.

Secondly, the majority of the assets in FLT's portfolio have freehold land tenures. This is an advantage which most Singapore's industrial properties lack. Freehold land tenures is important for long-term real estate investing. Let me explain. FLT owns properties in major cities of Australia, Germany and Holland. The governments are making it tougher every year to build new properties. The building codes/regulations are getting tougher, the zoning is getting more restrictive, and the construction costs are increasing at all levels. Vacant land is limited in cities like Brisbane, Sydney, Melbourne, Amsterdam, Dortmund, Hamburg and Munich. As a result, the value of freehold land in these major growing cities tend to appreciate over the long run. It is actually the value of the land that helps real estate perform favourably over time. Older warehouses are eventually torn down to build newer, better, higher-yielding ones.