Equity Portfolio Cost: S$559, 160

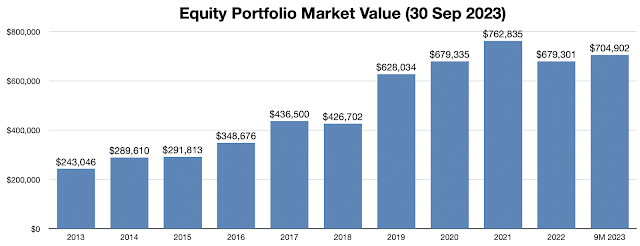

Equity Portfolio Market Value: S$704, 902

Equity Portfolio Unrealised Profit: +S$145, 742 (+26.1%)

Portfolio XIRR (9M 2023): -7.6% (inclusive of dividends)

Dividends Collected (9M 2023): S$33, 201 (+18.7% yoy)

Total Cumulative Dividends (2010 - 9M 2023): S$274, 707

Current Cash & Cash Equivalents (SSB/T-bills): S$43, 000

(*All figures are accurate as of 30 September 2023)

Portfolio Actions in Q3 2023:

- Initiated a position on Sheng Siong at S$1.50

- Accumulated more UOB at S$27.95

How I Prepare To Ride Through The Storm...

1. Diversify Into Recession-Proof, Cash-Rich Sheng Siong

Q3 2023 had been brutal to REITs as the US Fed signalled higher rates for longer to fight inflation. I foresee REITs' dpu to weaken in the coming quarters. Therefore, it is time to further optimise my portfolio for more sustainable passive income. Actually I already started this recalibration a couple of years back. Distributions from REITs were consistently re-invested into the local banks (DBS, UOB & OCBC), Big Tech & Propnex. These are cash-rich companies with strong balance sheets and business moats. Significantly higher dividend payouts from the banks have helped to mitigate the dip in REITs' dpu. Sheng Siong is my latest candidate. Due to the higher for longer rate environment, I would be pulling back on big REIT buys over the next few quarters. My firepower would switch to accumulating Sheng Siong. I am targeting around 5% allocation for Sheng Siong eventually. Due to sticky high inflation, more families are cooking at home. More value for money. Recent government policies tend to gravitate towards helping low to middle income families with the distribution of CDC vouchers. In 2024, each household will receive $150 CDC vouchers for spending at supermarkets. Sheng Siong should benefit from this assistance package.

2. Build A Bond Ladder with SSB & T-bills

Besides diversifying into recession-proof stocks like Sheng Siong, I am also building up a bond ladder. Starting from October, I would allocate some funds to Singapore Savings Bond and T-bills every month. As long as the yields remain attractive, I would continue to park some of my cash warchest in these fixed income instruments. In the event of a recession next year, I would have sufficient firepower to pounce on any opportunities.

3. Just Hold & Collect CD

In the meantime, I am not throwing the baby out with the bathwater. I would still be holding onto my core REIT positions. No knee-jerk reactions from me. Hold on to those that can weather the high interest rate environment until the end of 2024. For now, all my major REIT positions have below 40% gearing and a well spread out debt maturity profile (avoid REITs that have huge refinancing needs coming up in 2024). It also helps to have a strong reputable sponsor. The average entry prices of my REIT positions are low, so I can afford to hold. Secondly, over the last 14 years, I have collected more than S$270k in dividends which serves as a healthy buffer. Some investors prefer to cash out everything now and avoid REITs totally until US Fed start to cut rates. Well, I have learnt to stop waiting for the perfect conditions and all the stars to align. Market timing is futile. Being all-in or all-out is mentally exhausting.

Lastly, if you guys are worried about an impending recession, just visit VivoCity and Raffles City on the weekends or even weekdays. The crowd level is simply astonishing. Despite the higher prices at restaurants, business seems good.

"Successful investing is about managing risk, not avoiding it."

~Benjamin Graham~

Follow me on Twitter at https://twitter.com/DivyWarrior