Market corrections occur with surprising regularity but they never last. Euro debt crisis (PIIGS), Grexit crisis, US debt ceiling crisis, Fed QE TaperTantrums, Arab Spring revolution, Brexit referendum, Chinese market crash and oil price crisis. After the initial dips, the markets recovered, always.

Panicky investors who sold out in fear during those corrections would have missed out on the subsequent rallies. On the other hand, investors with better emotional fortitude would have stayed vested or even added to their portfolios. They prepare well for the market volatility and turned it to their advantage. They are unshakeable because they had 1)substantial warchest 2) knowledge and 3) clarity of mind to make the right long-term decisions when others were fearful.

A 'Self-Replenishing' Warchest Reduces Anxiety

In the context of a Singaporean working adult, I would categorise 'warchest' into cash savings (excludes emergency funds), bonds and CPF savings. We normally contribute to these sources of warchest from our monthly salaries and annual bonuses. So it is crucial to have a stable full-time job with decent pay. In my case, I have built an additional source of warchest, my income portfolio. It is essentially a cash-generating machine that churns out regular and rising cashflow every quarter.

|

| Funds earmarked for investing |

|

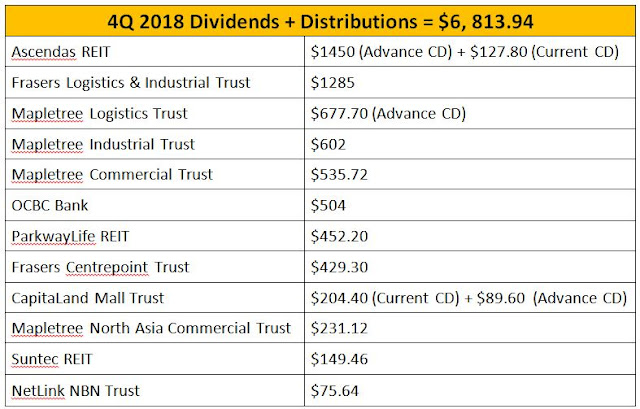

| A total of $123k dividends I collected over 9 years serves as a 'buffer' against market volatility |

At the beginning of my investing journey, the dividends I received was too miniscule to help boost my warchest. But after 9 years of prudent investing, the current amount of annual dividends I collect has become a meaningful contribution to my warchest. This frees up a larger portion of my salary, which I could choose to deploy into bonds and topping up of CPF. The CPF MA and SA offer 4% guaranteed interests per year. I treat my CPF savings as some sort of long-term 30-year 'bond' from the government.

A huge part of Warren Buffett's success in his early years came from his brilliant use of 'The Float' from his insurance company, Geico. To cut a long story short, Insurance policyholders would pay monthly premiums to Geico and Warren Buffett's Berkshire Hathaway then used this massive regular cashflow to invest for greater returns. The insurance premiums act like a cheap source of capital. Obviously, I do not posses the kind of firepower Buffett had in order to acquire a controlling stake in an insurance company! But I believe I had created my version of 'The Float'.

All dividends received are used to invest in high-quality dividend stocks and bonds. As my income portfolio grows over the long-term, it would generate more cashflow, which allows me to invest in even more dividend stocks and bonds. This perpetual re-investing cycle creates a powerful compounding effect, turning a small sum of money into a modest fortune. Furthermore, armed with an increasing flow of extra cash besides your monthly paycheck would strengthen your emotional fortitude. You would be less likely to deviate from your original investment plan. The longer you stick to this dividend re-investment cycle, the larger the cushion you could enjoy in a bear market. If you stay in the market long enough, compounding works its magic and you would be rewarded with a healthy return.

This is how you become wealthy while you sleep, letting money do the work for you. I know, all these sounds amazing and logical. Unfortunately, lots of people never take full advantage of this secret that's lying in full view. With this in mind, you would be less likely to panic sell everything at lower prices and head to the hills during a downturn.

Knowledge Of Companies & Recognising Market Patterns

Knowledge brings understanding, and understanding gives confidence. If you have done the necessary due diligence on the companies you are vested in and track their performance over the years, you would have stronger resolve to hold onto them when the market suffers a short-term dip. It's comical that some investors spend alot more effort on in-depth research when they buy smartphones or TVs than when they are buying stocks. These are the types of investors who tend to pull money out of the market at the first signs of danger as they are unsure if their stocks could withstand the storm. Uncertainty breeds fear. That's why I kept an excel sheet covering all essential metrics of a REIT. This excel sheet is updated every quarter. I know what makes my REITs tick. I understand their 'moats'. This gives me confidence to hold them long-term.

Scary headlines from merchants of doom such as Dr. Nouriel Roubini do not faze me one bit because I have recognised and accepted the fact that the markets move according to economic cycles. There would be periods of ups and downs. I also come to realise that the mainstream media thrive by scaring the living daylights out of investors. Analysts would bombard us with their seemingly compelling arguments. But they have been wrong repeatedly. If I listen to them everytime they release 'A market crash is coming!' or 'The bear market is here!', I would be hiding in my closet, clutching to a biscuit tin containing my life savings. But we all know that is definitely not a winning strategy for investment success. In my opinion, living in constant fear of corrections and crashes is just silly.

Instead of selling everything in a tumultuous market and locking in a loss of more than 20%, you should take advantage of all that fear and gloom. Invest in tranches at bargain prices. Opportunities come in periods of pessimism. Bear markets don't last, winter never lasts. Winter could be here but Spring always follows.

Systems Give Focus & Clarity Of Mind

An investor's worst enemy is likely to be himself. He can be fully equipped with a massive warchest and the best winning strategies an investor could have on the planet. But he could still mess it all up by making wrong decisions. Our brains are notoriously prone to bad decisions when it comes to money. I called this behaviour 'Financial Self-Sabotage'. Hahaha! Back in the depths of 2009 GFC, when we saw the red numbers blinking day after day on our computer screens, rationally, we knew that the smart long-term move was to buy more stocks at bargain prices. Unfortunately, the ancient survival mechanism in our brains were sending us conflicting messages that our portfolios were in mortal danger and needed to go into 100% cash until the threat was gone. This is commonly known as 'loss aversion'. Losing money causes so much pain that investors act irrationally just to avoid this scenario. Yes, our brains made us freak out. That's the side effect of the human survival mechanism.

So, how do we minimise the harmful effects of these mental biases and financial blind spots? Well, I decided to construct a system/checklist and stick to it. Sure, I have tweaked and refined the system through learning from mistakes over the years, but I was disciplined enough not to stray too far. I have a robust system that evaluates REITs. It has served me well so far, guiding me to divest weaker REITs like AIMS AMP, Sabana and Cache Logistics before switching to the well-run Mapletree REIT family I find myself less likely to panic and make costly, knee-jerk errors when I am confident that my investment decision is based on something concrete. Pretty sure traders have their set of systems too. Things like charting patterns, setting stop-loss & profit-taking levels, evaluating the risk-reward ratios and so on. Serious mistakes are usually made when investors are over-confident and become less rigorous in following their core systems which they built over the years.

This is similar to Warren Buffett's advice (the best one IMHO) to stay within your 'circle of competency'. If an investor knows his limitations, he can adapt and succeed. Otherwise, he would face psychological pitfalls. For example, I know stuff like cryptocurrencies, fine wine & art, antique cars etc. are way out of my circle of competency. I don't have a reliable system to evaluate Bitcoin (who does? Hahaha!) One moment, the price could surge 1000%, the next moment, it could plunge 2000%. I would be frustrated & terrified either way because I have no idea what's causing the whiplash in value.

I know exactly what I want my portfolio to be like since Day 1, hence the moniker, 'Dividend Warrior'. I want my portfolio to be filled with sold dividend-paying stocks. I focus on growing my dividend income stream year after year. Investors who are unfocused in their approach & objectives tend to end up with a 'Rojak portfolio' as they chase the 'flavour of the month' picks. I agree with InvestmentMoat that rojak is a tasty local dish, but it is a poor portfolio type. Typically, an investor with such a portfolio is directionless and would be the first to panic as he is at a lost during turbulent times. If you ask him for the reasons why he bought Stock A, he would probably reply that he could not even remember buying it. Maybe it was a hot tip from a friend or broker? Maybe it was a spur of the moment purchase?

Conclusion

To sum up, the 3 components mentioned above give me the peace of mind to stay the course in a world of uncertainty. Don't get me wrong, being unshakeable does not mean that nothing can ever upset me. It just means I am rarely knocked off balance for long periods of time. Being unshakeable means having the ability to regain composure quickly and take advantage of the turmoil surrounding us.

Every Crisis Is An Opportunity Not To Be Wasted

Dividend Warrior