|

| (Total cumulative dividends = S$212, 228) |

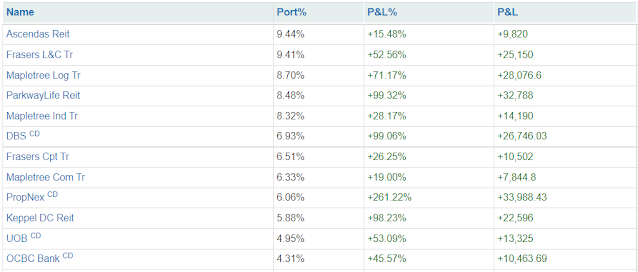

Top 12 Holdings (31 Mar 2022)

Portfolio Cost: S$542, 046

Portfolio Market Value: S$776, 062

Portfolio Overall Unrealized Profit: +S$234, 016 (+43.2%)

Portfolio XIRR (Q1 2022): +7.01%

Dividends Collected (Q1 2022): S$5, 450

Total Cumulative Dividends (2010-2022): S$212, 228

Current Cash Warchest: S$21, 600

(*All figures are accurate as of 31 Mar 2022)

Portfolio Actions in Q1 2022:

- Divested Sea Group at US$193, taking a loss of -33.4%

- Accumulated 3 tranches of Tesla at US$1038, US$908 and US$850

- Accumulated more Microsoft at US$308

- Accumulated more CapitaLand China Trust (CLCT) at S$1.16

Doubling Down on Tesla

Growth continues to slow down for the gaming unit of Sea Group. Garena is the sole profit-generating business for Sea Group. The cash-burning business model of Shopee looks set to continue as they compete against Lazada in the Southeast Asia e-commerce market. With the new digital banking service launching soon, I foresee the cash-burn rate to remain elevated. Since Sea Group makes up a tiny portion of my portfolio, I decided to cut my losses and re-invest the sale proceeds into Tesla.

The growth trajectory of this EV giant over the next 5 years is significantly clearer, with the opening of Giga Berlin and Giga Texas. The global demand for EVs is set to increase exponentially and Tesla is way ahead of its competitors who are struggling harder with chips and battery shortage. Tesla has already established a supercharger network (~30,000 points worldwide) whereas its competitors are now just starting to build their charging infrastructure. The legacy automakers are way behind Tesla in terms of securing more supplies of rare metals for large-scale battery production. So, I believe cutting the 'weed' that is Sea Group and doubling down on a hypergrowth, disruptive winner like Tesla is the right choice. With this latest accumulation, Tesla has moved into my top 15 positions. It is now my largest growth counter.

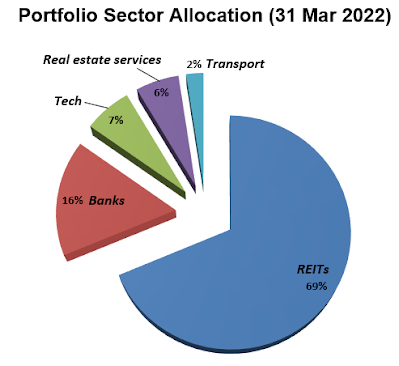

Fed Rate Hike Cycle Starts

By now, we can all agree that inflation is no longer transitory. In a bid to combat inflation from running away, the US Federal Reserve has started the rate hike cycle in March. The market is guiding six more small hikes by the end of 2022. The monetary tightening is likely to be gradual. REITs are widely expected to react negatively to this development. But lo and behold, most of them started to grind higher! Contrary to popular belief, REITs tend to perform relatively well in an inflationary environment. The last time the US had hyperinflation in the 1970s, REITs outperformed many other sectors. As long as Uncle Powell communicate subsequent rate hikes clearly, I believe REITs will keep chugging along just fine.

A New World Order? Not So Quick...

Talk of a new world order emerging is a little bit of a hyperbole. It is still pre-mature to talk about a changing world order when the top five largest companies in the world are still American. Apple, Microsoft, Amazon, Alphabet and Tesla are not fading away anytime soon. In fact, these giants are still expanding. Their products and services firmly entrenched in our daily lives. Look, don't get me wrong. China is a close second in the world order and catching up. But they also have a host of domestic problems. A heavily leveraged real estate sector where the Chinese have most of their wealth in. Birth rates falling off the cliff. Population aging rapidly within one generation.

I prefer to take a more balanced approach on this. Diversify some funds into the China market. No all-in. Never all-in. Demand for modern logistics properties and data centres would continue to grow in China. That is why I accumulated more CapitaLand China Trust. Collecting rent from the China market wouldn't hurt, right?

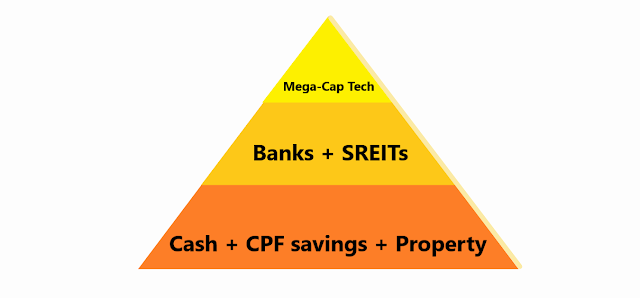

Sticking to my 'Life goes on' Plan

Still on track to hit S$800k portfolio value and S$33k in annual dividends by year end. Often I ask myself what kind of events would be catastrophic enough to end my portfolio. Short of an asteroid striking Earth or an all-out nuclear war, my current portfolio should prevail. Even a two-year global pandemic could not destroy it. Life always finds a way. Probably the beauty of capitalism? It has this power of renewal. So, I would urge all of you to come up with your own version of the 'Life goes on' plan and stick to it.

Never quit. Keep moving forward. Keep compounding. Navigating through crises. Long-term investing is not just about survival. It is more about prevailing. There is a difference. That's the beauty of dividend investing. No matter if the market is up, down or sideways, you are still getting paid. There is a certain... comfort in knowing that. People always talk about 'Financial Freedom' or 'Financial Independence'. Well, how about some 'Financial Comfort'?

Be Financially Comfortable

Dividend Warrior

Follow me on Twitter at https://twitter.com/DivyWarrior