Wednesday, December 25, 2019

Growth Catalysts For Suntec REIT In 2020

Saturday, November 16, 2019

Saturday, November 9, 2019

Sunday, November 3, 2019

Dividend Warrior's Top Defensive REIT - The King Of S-REITs!

Singaporean parents want their children to become successful and well-paid lawyers, doctors and bankers. Some people do not end up in these top-tier professions. That's just life. So, what's the next best thing to do. Well, we can try to milk them for rental income. For example, Mount Elizabeth Hospital and Gleneagles Hospital have some of the best healthcare talents in the region. By investing in ParkwayLife REIT, unit-holders are essentially banking on the earning abilities of specialist doctors and rising demand for better healthcare services. Furthermore, the huge number of Japanese nursing homes in ParkwayLife REIT's portfolio also allows unit-holders to benefit from Japan's aging population, which is pretty much a guaranteed long-term trend. It is not cyclical. There are other reasons why this premium healthcare REIT is my top 'defender'.

- The manager has never sought a general mandate to issue new units. In other words, they were able to grow the DPU and NAV of the REIT without using private placements, preferential offerings or rights issues, ever. Their focus is sustainable, modest growth over long-term. Their track record is hard proof. 11 consecutive years of DPU growth. They even managed to generate capital gains from divesting older assets.

- Their Singapore hospitals are operated under very long leases of (15 + 15) years since 2007. Their Japanese nursing homes have a WALE of 12.8 years.

- Leases are structured in a way that 90% of the rents for the entire portfolio have downside protection. 60% of rents are pegged to inflation rate. Its Singapore hospitals have a guaranteed 1% growth in minimum rent annually. Yes, guaranteed. How awesome is that!

- Debt maturity profile is well spread out over 3 years. Very little refinancing needs this year and next. All-in cost of debt is ridiculously low at 0.93%, compared to other S-REITs. The interest cover is 13.5 times, highest among S-REITs.

Friday, October 18, 2019

Saturday, October 5, 2019

Dividend Warrior's 9M2019 Portfolio Quick Update - $600k Milestone Achieved!

Is it just me, or is the world getting crazier out there? Donald Trump facing impeachment, Boris muddling towards Bexit, violent rioters getting shot in Hong Kong, political tensions escalating between Japan & South Korea. Oh, don't forget about a teenager lecturing full-grown adults at the United Nations on the subject of global warming and the eventual mass extinction of humans. Meanwhile, fires in the Amazon forest raged on, sending more greenhouse gases into the atmosphere. On the economic front, manufacturing figures and factory output from nations such as China, Germany and Japan continue to trend down. FedEx earnings & sales missed market expectations. HP planning to cut up to 9,000 jobs worldwide. September automobile sales dropped in the US. President Trump slapped 25% tariffs on various European goods & products. I'm not holding my breath for a successful trade deal between the US and China anytime soon. It's gonna drag on for sure.

It seems the only group of people who still care about the global economy and took decisive actions were the central banks. The US Federal Reserve and European Central Bank cut rates in the third quarter. Following the footsteps of Japan, bond yields in Europe have gone negative too. Slowing growth, stubbornly low inflation and lack of real wage growth in the developed nations. That's the state of the world right now. There is no alternative (TINA) but to hunt for higher yields in REITs and dividend stocks. Assets which are generating stable cashflow are in demand. There is no way the central banks can afford to hike rates and risk a global recession. Interest rates are never going back to the previous high of 5%, not in the near future anyway. Luckily, Singapore is a leading REITs hub in Asia. We should capitalise on this niche advantage.

Portfolio Cost: S$458, 587

Portfolio Market Value: S$604, 955

Portfolio Overall Unrealized Profit: S$146, 368

Dividends Collected (9M2019): S$19, 210

Current Warchest: S$8, 000

Portfolio Actions in 3Q2019:

It seems the only group of people who still care about the global economy and took decisive actions were the central banks. The US Federal Reserve and European Central Bank cut rates in the third quarter. Following the footsteps of Japan, bond yields in Europe have gone negative too. Slowing growth, stubbornly low inflation and lack of real wage growth in the developed nations. That's the state of the world right now. There is no alternative (TINA) but to hunt for higher yields in REITs and dividend stocks. Assets which are generating stable cashflow are in demand. There is no way the central banks can afford to hike rates and risk a global recession. Interest rates are never going back to the previous high of 5%, not in the near future anyway. Luckily, Singapore is a leading REITs hub in Asia. We should capitalise on this niche advantage.

Top 15 Core Holdings (As of 30 Sep 2019)

Portfolio Cost: S$458, 587

Portfolio Market Value: S$604, 955

Portfolio Overall Unrealized Profit: S$146, 368

Dividends Collected (9M2019): S$19, 210

Current Warchest: S$8, 000

Portfolio Actions in 3Q2019:

- Initiated small position in Hong Kong Land

- Averaged down on Propnex, which overtook Suntec REIT as my 15th largest core holding

- Applied 2000 units for Keppel DC REIT preferential offering

Wednesday, September 4, 2019

How Dividend Warrior Transformed His Portfolio In 2016 Bear Market?

Low Interest Rates Are Here To Stay

My portfolio tends to evolve after every deep market correction as I find ways to improve on it. During the last serious bear market in 2016, I divested those weaker, 2nd-tier REITs such as AIMS AMP, First REIT and Cache Logistics. The raging oil price crisis in 2016 gave investors the perfect opportunity to go big into top-tier REITs as well as the 3 local banks because their valuations were rather beaten down. Too much irrational fear over the banks' NPL exposure from the O&G sector back in those days.

So, I made the transition, believing that I would reap solid returns in the future as it is almost impossible for the US Fed to hike rates up to 3%. Forward-looking is important. Thanks to my lucky stars, my bold decision was proven right as the market rallied beautifully in 2017. By the end of 2017, my portfolio transformation was pretty much complete, a combination of banks and quality REITs. Dividends and growth.

Remarkably, those top-tier REITs with strong competent sponsors like Mapletree, Frasers, CapitaLand, Ascendas and Keppel kept growing their DPU and the 3 local banks had since increased their dividend payouts. Even today, all the Mapletree REITs remain resilient in the face of escalating US-China trade war, hard Brexit and increasingly violent Hong Kong riots. I intend to repeat this formula shall the market experience such a steep decline again.

If you are interested, you can check out how my portfolio evolved in 2016 over here and here. Got picture got talk, right? Hahaha! ^__^

My portfolio tends to evolve after every deep market correction as I find ways to improve on it. During the last serious bear market in 2016, I divested those weaker, 2nd-tier REITs such as AIMS AMP, First REIT and Cache Logistics. The raging oil price crisis in 2016 gave investors the perfect opportunity to go big into top-tier REITs as well as the 3 local banks because their valuations were rather beaten down. Too much irrational fear over the banks' NPL exposure from the O&G sector back in those days.

So, I made the transition, believing that I would reap solid returns in the future as it is almost impossible for the US Fed to hike rates up to 3%. Forward-looking is important. Thanks to my lucky stars, my bold decision was proven right as the market rallied beautifully in 2017. By the end of 2017, my portfolio transformation was pretty much complete, a combination of banks and quality REITs. Dividends and growth.

Remarkably, those top-tier REITs with strong competent sponsors like Mapletree, Frasers, CapitaLand, Ascendas and Keppel kept growing their DPU and the 3 local banks had since increased their dividend payouts. Even today, all the Mapletree REITs remain resilient in the face of escalating US-China trade war, hard Brexit and increasingly violent Hong Kong riots. I intend to repeat this formula shall the market experience such a steep decline again.

If you are interested, you can check out how my portfolio evolved in 2016 over here and here. Got picture got talk, right? Hahaha! ^__^

"To improve is to change, so to be perfect is to have changed often."

~ Winston Churchill

Sunday, September 1, 2019

Dividend Warrior's YTD Portfolio Performance Snapshot

Everyday, most people have to get up early, get squeezed like sardines on the MRT trains/public buses as they travel to their workplace. They then work non-stop like a machine for half a day, impress their bosses and receive a salary at the end of each month. Lots of people are forcing themselves to do this daily even though they dread it. Why? Well, they need money to support themselves and their families, to fulfill their needs and wants in life. The more needs and wants a person desires, the more income he has to earn. This income earned through effort and time is called 'active income'. Sometimes, the job can be so strenuous that you not only sacrifice time but also your health. You might even wonder if your salary is worth all that sacrifice. Financial independence is being able to receive income without having to sacrifice time, health or anything else that might be precious to you. This is the progress I have made so far in my journey towards 'FIRE'.

Portfolio Market Value: S$597,228

Projected Dividends in 2020: S$28.6K

Cash warchest: S$10,160

Gold coins: S$3,000

CPF OA: S$131,000 (*Shall be used to fully pay for BTO flat)

Total Networth: S$741,388 (At 30 Aug)

Portfolio Market Value: S$597,228

Projected Dividends in 2020: S$28.6K

Cash warchest: S$10,160

Gold coins: S$3,000

CPF OA: S$131,000 (*Shall be used to fully pay for BTO flat)

Total Networth: S$741,388 (At 30 Aug)

|

| Top 12 Core Holdings |

Wednesday, August 21, 2019

The Power Of Compounding Dividends & A Mystery Counter Revealed

The Snowball Effect Over Last 5 Years

My overall portfolio value as well as dividend stream has grown considerably since 2014. Besides injecting fresh capital, consistently re-investing my dividends has started to make an impact. Compounding growing dividends over long periods of time has been the cornerstone of my investing strategy. I believe this strategy is probably one of the best 'wealth-creating machines' on earth, especially for the ordinary man on the street. Tried and tested.

Top 10 Core Holdings

My overall portfolio value as well as dividend stream has grown considerably since 2014. Besides injecting fresh capital, consistently re-investing my dividends has started to make an impact. Compounding growing dividends over long periods of time has been the cornerstone of my investing strategy. I believe this strategy is probably one of the best 'wealth-creating machines' on earth, especially for the ordinary man on the street. Tried and tested.

|

| Time in market is better than timing the market |

|

| Are you able to spot the mystery counter? :) |

Thursday, August 15, 2019

Returns On University Education

Going through the public education system is a rite-of-passage for most Singaporean children. The Singapore education system is highly-regarded world-wide on most measures. School fees are heavily subsidised from kindergarten to Junior College levels. It is generally considered worthwhile for students and parents to 'invest' time, effort and money into this glorious 20-year 'paper chase'. However, the ROIC (Returns On Invested Capital) becomes trickier at the tertiary level. Is it still worthwhile pursuing that part-time degree at a private university like SIM?

Many years ago, one of my friends got a degree from SIM after spending close to S$30k on fees and 3 years of his life. When I casually probed him about the motivations behind his pursuit of this degree, he gave me the expected answers. "I wanted to make my parents proud. I see many of my friends and relatives are graduates and I want to be like them. I wanted to show them I am smart too. Having a degree will help me get a better-paying job too." Sadly, he was wrong on all accounts. Sure, his parents were initially proud of him, smiling widely at the graduation ceremony. They probably have the old-fashion mindset of equating a degree to a lucrative job. Well, times have changed. Graduates of all kinds are flooding the job market now.

Secondly, getting a degree from SIM will not make you appear 'smart' to your friends, relatives or future employer. In fact, it has quite the opposite effect. That degree from SIM actually showed my friend's academic mediocrity when placed against other candidates from more prestigious universities like NUS/NTU/SMU.

He gave up searching for a proper, full-time job after 2 years. Don't worry, he did not end up driving for Grab or delivering food for FoodPanda. He spent the next 8 years dabbling in 'small' businesses which he claimed vehemently he was passionate in. His latest business venture is running a pomelo farm in Vietnam. So far, he has little returns to show for it and almost no CPF savings at all. The harsh reality is that in the end, the ROC of his university education was practically zero. 3 years of his life and S$30k in fees down the drain, forever, plus opportunity costs. He did not get the status, recognition and job security that he thought he would.

To conclude, I guess my hard-truth message to those impressionable youngsters out there who are dealing with social/peer pressures is this - if you plan to get a sub-par degree from a sub-par university, you are better off not getting one.

Many years ago, one of my friends got a degree from SIM after spending close to S$30k on fees and 3 years of his life. When I casually probed him about the motivations behind his pursuit of this degree, he gave me the expected answers. "I wanted to make my parents proud. I see many of my friends and relatives are graduates and I want to be like them. I wanted to show them I am smart too. Having a degree will help me get a better-paying job too." Sadly, he was wrong on all accounts. Sure, his parents were initially proud of him, smiling widely at the graduation ceremony. They probably have the old-fashion mindset of equating a degree to a lucrative job. Well, times have changed. Graduates of all kinds are flooding the job market now.

Secondly, getting a degree from SIM will not make you appear 'smart' to your friends, relatives or future employer. In fact, it has quite the opposite effect. That degree from SIM actually showed my friend's academic mediocrity when placed against other candidates from more prestigious universities like NUS/NTU/SMU.

He gave up searching for a proper, full-time job after 2 years. Don't worry, he did not end up driving for Grab or delivering food for FoodPanda. He spent the next 8 years dabbling in 'small' businesses which he claimed vehemently he was passionate in. His latest business venture is running a pomelo farm in Vietnam. So far, he has little returns to show for it and almost no CPF savings at all. The harsh reality is that in the end, the ROC of his university education was practically zero. 3 years of his life and S$30k in fees down the drain, forever, plus opportunity costs. He did not get the status, recognition and job security that he thought he would.

To conclude, I guess my hard-truth message to those impressionable youngsters out there who are dealing with social/peer pressures is this - if you plan to get a sub-par degree from a sub-par university, you are better off not getting one.

Sunday, August 11, 2019

Dividend Warrior's Football 'Portfolio' Team (19/20 Season)

This post on my 'portfolio' soccer team was one of my most read posts last year. So, I decided to do another one :)

This season, I shall be using the 4-3-3 formation. This formation offers the best flexibility in the current low interest rate, slow growth macro environment. The pace and movement of the veteran attackers, support of the fullbacks, and offensive midfielders will combine to overload the opponent's defence with 'Power of CD'. I believe this formation can be a massive success if you have the right players to play to its strengths. You can sit back in a 4-5-1 formation when under pressure (market correction) and hit the opponent on the counter-attack (deploy cash warchest). Or the fullbacks can push forward and the defensive midfielder drops back between the two centre-backs to form a 3-4-3 formation (sit tight and collect CD). I have signed a new, top quality inside forward (UOB) on 14 May.

Substitutes bench: CMT, SATS, FLT, Propnex, APAC Realty, HRnet, F&N

This season, I shall be using the 4-3-3 formation. This formation offers the best flexibility in the current low interest rate, slow growth macro environment. The pace and movement of the veteran attackers, support of the fullbacks, and offensive midfielders will combine to overload the opponent's defence with 'Power of CD'. I believe this formation can be a massive success if you have the right players to play to its strengths. You can sit back in a 4-5-1 formation when under pressure (market correction) and hit the opponent on the counter-attack (deploy cash warchest). Or the fullbacks can push forward and the defensive midfielder drops back between the two centre-backs to form a 3-4-3 formation (sit tight and collect CD). I have signed a new, top quality inside forward (UOB) on 14 May.

Substitutes bench: CMT, SATS, FLT, Propnex, APAC Realty, HRnet, F&N

Wednesday, August 7, 2019

Dividend Warrior's 3Q2019 S-REITs Performance And Passive Income Update

Sunday, June 30, 2019

Dividend Warrior 1H2019 Portfolio Update - Best Quarter Ever!

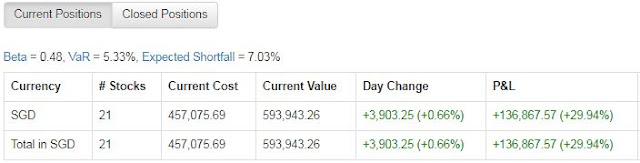

Portfolio Cost: S$457, 975

Portfolio Market Value: S$593, 943 (+39.2% year-on-year)

Portfolio Overall Unrealized Profit: S$135, 968 (+29.7%)

Portfolio YTD Unrealized Profit: S$68, 660 (+11.5%)

Portfolio XIRR (including dividends): 14.63%

Portfolio XIRR (2019): 48.71%

Dividends Collected (1H2019): S$13, 410 (+11.6% year-on-year)

Current Warchest: S$7, 800

Portfolio Actions in 2Q2019:

- Initiated positions in APAC Realty, Propnex Group, HRnet Group, F&N and UOB

- Took SCRIP dividends for OCBC

- Took SCRIP dividends for Raffles Medical

- Applied & allocated 1000 units for Frasers Centrepoint Trust's preferential offering

Singapore Market Becoming A Top Hub For REITs

Global markets had quite a roller-coaster ride from May to June, right? It had been a hectic quarter as I opened my warchest and deployed funds according to my preset investment plan. The escalating trade tensions between the US and China turned out to be a blessing in disguise, especially for my portfolio. A synchronized global slowdown would prompt the US Federal Reserve to be more dovish in the second half of 2019. And we all know REITs generally thrive in a dovish environment. First, prolonged low interest rates would reduce the burden of debt refinancing for REITs. Although the REITs I am currently holding have healthy gearing ratios (below 38%), I don't mind a 'helping hand' from a dovish Fed. Second, an extended period of low interest rates would lead to a world that is hungry for yield, thus boosting the demand for yield instruments such as REITs. Those glorious days of high fixed deposit interest rates are not coming back, ever. This is the new norm now. We have to face reality and make the best of it.

Singapore's economy has become a capitalistic utopia/dystopia, depending on your perspective. It is a system of rental income extraction by entrenched giant landlords (REITs). Many developed countries with matured real estate markets do show similar signs. For example, collectively, the local retail market is dominated by CMT, FCT, MCT, Suntec REIT and Starhill Global. If one is invested in all these retail REITs, he/she would essentially gain exposure to almost all major shopping malls in Singapore. The Pioneer Generation did not have the opportunity to participate in this rental extraction bonanza. As the third generation Singaporeans, we should thank our lucky stars and try our best to extract as much financial benefits as possible out of this 'rental economy'. In my opinion, real estate is one of the very few business sectors left that is still resilient to disruption. For example, even a disruptive and fast-growing tech company like Grab has to lease office space for its employees. Grab will be leasing its new, state-of-the-art headquarters from Ascendas REIT at One-North business park. This new building will house Grab's largest R&D centre as well as around 3000 employees. Being a unitholder of AREIT, I stand to capture some of Grab's future growth indirectly.

Less Obsessed On Beating The Market

The grim reality is that most retail investors fail to beat the market over the long-term. Even professional active investment fund mangers struggled to outperform the market consistently over many years. All the fees and commissions erode long-term returns. The more actively you trade, the more harm you do to your portfolio. Our worst enemies in investing are often ourselves. So, how do we, as individual investors, beat the market? Well, we don't. Ignore the 'beat the market' hype that pervades the investing scene.

We are not highly-paid fund managers who need to answer to demanding clients every quarter. No one to pressure me to take profits when the market appears 'frothy'. No need to chain ourselves rigidly to the STI performance benchmark. We are not competing against rival managers to attract more clients. We are in competition only with ourselves. I am alright that my portfolio performance does not beat the STI every year, as long as my dividend growth rate does. Don't get me wrong, I am not saying it is fine for my portfolio to be decimated more than 50% in a year. Nobody wants that! I'm just saying that I am no longer obsessed with a few percent gyrations in my overall portfolio. In any given year, under-performing the STI by 2%-5% is no big deal to me. I stick to my dividend growth strategy.

Be Informed Consumers Of Media

News can be a good source of information if you are able to interpret and use it properly to your advantage. Avoid knee-jerk reactions to every headline. Most media outlets are profit-driven businesses. They want to turn a profit. They must turn a profit, or else they will go out of business. Their bread and butter is always selling advertising. To garner higher advertising revenues, they must attract eyeballs. The new views they get, the more the advertisers are willing to pay. As the saying goes 'If it bleeds, it leads'. News programmers know, if they lead the evening prime-time news with a heart-warming story of students performing a concert at a nursing home, no one will watch. They know they must lead with fire, mayhem, murder, robbery, riots, scandals and controversies. Bad news sells, especially Trump's tariff tweets. This is the media industry's way of maximizing profits.

The more your money works for you, the less you have to work for money

Dividend Warrior

Subscribe to:

Posts (Atom)