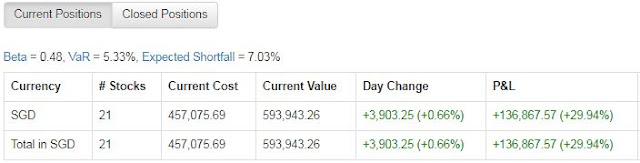

Portfolio Cost: S$457, 975

Portfolio Market Value: S$593, 943 (+39.2% year-on-year)

Portfolio Overall Unrealized Profit: S$135, 968 (+29.7%)

Portfolio YTD Unrealized Profit: S$68, 660 (+11.5%)

Portfolio XIRR (including dividends): 14.63%

Portfolio XIRR (2019): 48.71%

Dividends Collected (1H2019): S$13, 410 (+11.6% year-on-year)

Current Warchest: S$7, 800

Portfolio Actions in 2Q2019:

- Initiated positions in APAC Realty, Propnex Group, HRnet Group, F&N and UOB

- Took SCRIP dividends for OCBC

- Took SCRIP dividends for Raffles Medical

- Applied & allocated 1000 units for Frasers Centrepoint Trust's preferential offering

Singapore Market Becoming A Top Hub For REITs

Global markets had quite a roller-coaster ride from May to June, right? It had been a hectic quarter as I opened my warchest and deployed funds according to my preset investment plan. The escalating trade tensions between the US and China turned out to be a blessing in disguise, especially for my portfolio. A synchronized global slowdown would prompt the US Federal Reserve to be more dovish in the second half of 2019. And we all know REITs generally thrive in a dovish environment. First, prolonged low interest rates would reduce the burden of debt refinancing for REITs. Although the REITs I am currently holding have healthy gearing ratios (below 38%), I don't mind a 'helping hand' from a dovish Fed. Second, an extended period of low interest rates would lead to a world that is hungry for yield, thus boosting the demand for yield instruments such as REITs. Those glorious days of high fixed deposit interest rates are not coming back, ever. This is the new norm now. We have to face reality and make the best of it.

Singapore's economy has become a capitalistic utopia/dystopia, depending on your perspective. It is a system of rental income extraction by entrenched giant landlords (REITs). Many developed countries with matured real estate markets do show similar signs. For example, collectively, the local retail market is dominated by CMT, FCT, MCT, Suntec REIT and Starhill Global. If one is invested in all these retail REITs, he/she would essentially gain exposure to almost all major shopping malls in Singapore. The Pioneer Generation did not have the opportunity to participate in this rental extraction bonanza. As the third generation Singaporeans, we should thank our lucky stars and try our best to extract as much financial benefits as possible out of this 'rental economy'. In my opinion, real estate is one of the very few business sectors left that is still resilient to disruption. For example, even a disruptive and fast-growing tech company like Grab has to lease office space for its employees. Grab will be leasing its new, state-of-the-art headquarters from Ascendas REIT at One-North business park. This new building will house Grab's largest R&D centre as well as around 3000 employees. Being a unitholder of AREIT, I stand to capture some of Grab's future growth indirectly.

Less Obsessed On Beating The Market

The grim reality is that most retail investors fail to beat the market over the long-term. Even professional active investment fund mangers struggled to outperform the market consistently over many years. All the fees and commissions erode long-term returns. The more actively you trade, the more harm you do to your portfolio. Our worst enemies in investing are often ourselves. So, how do we, as individual investors, beat the market? Well, we don't. Ignore the 'beat the market' hype that pervades the investing scene.

We are not highly-paid fund managers who need to answer to demanding clients every quarter. No one to pressure me to take profits when the market appears 'frothy'. No need to chain ourselves rigidly to the STI performance benchmark. We are not competing against rival managers to attract more clients. We are in competition only with ourselves. I am alright that my portfolio performance does not beat the STI every year, as long as my dividend growth rate does. Don't get me wrong, I am not saying it is fine for my portfolio to be decimated more than 50% in a year. Nobody wants that! I'm just saying that I am no longer obsessed with a few percent gyrations in my overall portfolio. In any given year, under-performing the STI by 2%-5% is no big deal to me. I stick to my dividend growth strategy.

Be Informed Consumers Of Media

News can be a good source of information if you are able to interpret and use it properly to your advantage. Avoid knee-jerk reactions to every headline. Most media outlets are profit-driven businesses. They want to turn a profit. They must turn a profit, or else they will go out of business. Their bread and butter is always selling advertising. To garner higher advertising revenues, they must attract eyeballs. The new views they get, the more the advertisers are willing to pay. As the saying goes 'If it bleeds, it leads'. News programmers know, if they lead the evening prime-time news with a heart-warming story of students performing a concert at a nursing home, no one will watch. They know they must lead with fire, mayhem, murder, robbery, riots, scandals and controversies. Bad news sells, especially Trump's tariff tweets. This is the media industry's way of maximizing profits.

The more your money works for you, the less you have to work for money

Dividend Warrior

4 comments:

Congrats!

Can make a guess. Non reit non bank is centurion ?

You are such an inspiration!

Great post! There has been a lot of negative news recently but the market has performed better instead. As retail investors, we cant influence the market like the big boys fund mgrs. But we can choose to stick with our own strategy 😁 Enjoyed reading and learning from yours!

Post a Comment