~ The Future Is Living In A Tech Ecosystem ~

Friday, December 25, 2020

Sunday, December 20, 2020

Tuesday, December 15, 2020

Friday, November 6, 2020

Monday, October 12, 2020

Propnex & Banks Leading The Phase 3 & Post-Covid Counter Attack!

The counter-attack begins

The stock market is forward-looking. It tends to reflect the real economy one to two quarters in advance. Over the last couple of weeks, various countries in Asia have been discussing to launch green lanes and travel bubbles. The Singapore government is also planning to take the nation into Phase 3 re-opening. All positive developments.

Just as I anticipated, the local residential property market will be one of the leading sectors as the economic recovery gets into full-steam. And we all know the property market and banking sector work hand-in-hand. More housing sales potentially translate to loan growth for the banks. Younger workers in IT/Tech sectors and civil servants with more stable income have been driving up demand in the local property market. With the largest market share, my playmaker (Propnex) shall be leading the counter-attack with the forwards (DBS, UOB & OCBC). Even after the pandemic is gone, my defence (Blue-chip REITs) will continue to provide a stable foundation. They are the 'spine' of my portfolio football team!

E-commerce is not enjoyable

Besides spending on big-ticket items like a property, consumer spending should slowly return to pre-covid levels. Singapore is a densely-populated island with hot and humid weather all-year round. Visiting the shopping malls, especially the suburban ones is part of our lifestyle. I would even say malls form a part of our social fabric. There is no alternative. The 2-month Circuit Breaker has proven that a 100% e-commerce model in Singapore is no fun. We were close to being prisoners in our own homes, clicking the 'Order/Buy' button on computers or smartphones. Brick-and-mortar stores still serve a purpose. Having meals and drinks at eateries, cafes or restaurants is still a better experience. A freshly-cooked, piping hot fried pork cutlet taste so much better than a home-delivered one. Or a pasta dish. By the time the pasta reaches your doorsteps, it is no longer al dente. I am confident in the revival of suburban retail malls. That's why I shall support FCT's preferential offering.

Thursday, October 1, 2020

Dividend Warrior's 9M2020 Portfolio Update - Green Shoots of Recovery!

Portfolio Cost: S$477, 451

Portfolio Market Value: S$ 642, 893

Portfolio Overall Unrealized Profit: S$165, 442 (+34.65%)

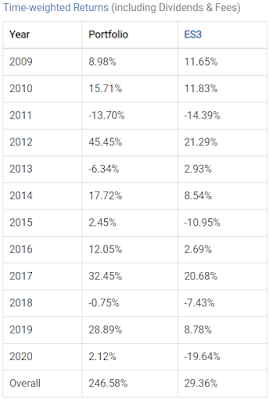

Portfolio YTD Returns: +2.12%

Dividends Collected (9M2020): S$18, 060

Current Warchest: S$63, 000

(*All figures are accurate as of 30 Sep 2020)

Portfolio Actions in 3Q2020:

- Accumulated 200 shares of UOB at $19.67 and another 300 shares at $19.32

- Initiated a position of 2000 shares of VICOM at $2.13

- Initiated a position of 1000 shares of CapitaLand at $2.71

- Fully subscribed to OCBC's SCRIP dividends

- Partially subscribed to DBS' SCRIP dividends

Sunday, September 6, 2020

Post-COVID 19 Recovery Play - Giant Retail & Office LandLords

|

| Own cash-generative, monopoly-like assets |

Frasers Centrepoint Trust (FCT) has proposed to acquire 5 new shopping malls. The merger between CapitaLand Mall Trust (CMT) and CapitaLand Commercial Trust (CCT) would create the largest REIT in Singapore, CapitaLand Integrated Commercial Trust (CICT) by the end of 2020. Besides these 2 mega REITs, if one is also vested in Mapletree Commercial Trust (MCT), he/she would be well-positioned for the post-COVID recovery once the HarbourFront precinct is fully redeveloped. In fact, shoppers and diners have begun streaming back to the malls, especially on weekends. After witnessing the crowds, I am starting to question if the current recession is as bad as originally reported. The malls owned by FCT, CMT and MCT are conveniently located near MRT stations and large population catchment areas, thus ensuring high human footfall. They enjoy a monopolistic grip over strategically-located retail spaces in Singapore. As long as there is no second Circuit Breaker (fingers-crossed!), these 3 retail & commercial REITs are solid long-term recovery plays in my opinion. Huge dose of patience required. Collecting rental income from forty properties. FORTY!!!

Monday, August 31, 2020

Dividend Warrior's Football 'Portfolio' Team (20/21 Season)

- CapitaLand Mall Trust

- Frasers Centrepoint Trust

- Mapletree Commercial Trust

- Suntec REIT

- Frasers Property Ltd

- ComfortDelgro

- VICOM

- Hong Kong Land

Saturday, August 8, 2020

Saturday, August 1, 2020

Dividend Warrior's July 2020 Portfolio Quick Update - 5 Tiger Generals Riding on Data Centre & Logistics Wave!

Sunday, July 12, 2020

Dividend Warrior's 2Q2020 Net Worth Update - $800k New Milestone Achieved!

My personal liquid asset networth finally exceeded $800k for the first time in June 2020! Having a stable job that was largely unaffected by the COVID-19 pandemic was helpful for sure. It allows me to build up my warchest while deploying dividends on my stock portfolio. Besides, I have no debts to service. No housing loan. No car loan. Zero, zip, zlich, nada!

- Nibbled DBS & UOB in Mar 2020

- Nibbled UOB in Jun 2020

Furthermore, my job allows me to consistently contribute to my CPF account, thus building up my OA savings. The construction progress of my BTO flat has been held up a little by the 2-month circuit breaker in April-May. But I am assuming it is still on track to be completed by 1H2023.

Most local restaurants and eateries seemed to be doing brisk business since the Phase 2 re-opening. I was able to satisfy my Chinese soup dumplings craving at Paradise Dynasty! ^__^

Don't go through life. GROW through life.

Dividend Warrior

Tuesday, July 7, 2020

Dividend Warrior's 1H2020 Portfolio Update - Road To A Slow Recovery

|

| Top 10 Positions as of 30 Jun 2020 |

|

| Warchest |

Portfolio Cost: S$488, 490

Portfolio Market Value: S$ 606, 435

Portfolio Overall Unrealized Profit: S$117, 945 (+24.1%)

Portfolio YTD Returns: -1.75%

Dividends Collected (1H2020): S$12, 885

Current Warchest: S$52, 457

(*All figures are accurate as of 30 Jun 2020)

Portfolio Actions in 2Q2020:

- Accumulated 200 shares of UOB at $20.76

Well-Prepared To Ride Out The Storm

Like most businesses all over the world, banks faced serious COVID-19 headwinds during the first half of 2020 and would probably continue to do so in the coming quarters. Earnings projections should be lowered in 2020-2021 due to reduced NIM and negative loan growth. Overall business sentiment is expected to be poor for the rest of 2020. The saving grace would be the private wealth segment. I re-invested my dividends by accumulating UOB at $20.76, which is below its NAV of $22.32. UOB enjoys a larger revenue exposure to the ASEAN region compared to DBS and OCBC. Besides, I am happy with my current allocation on DBS and OCBC, so I decided to boost my long-term UOB position. Investing in a quality company at a fair price is better than investing in an average company at an attractive price. Even if UOB cuts its FY2020 dividend payout from $1.30 per share to $1 per share, the yield is still fair in the current zero-rate environment.

There is an increased probability that the local banks might re-activate their SCRIP dividend scheme in order to build up cash reserves for tougher times ahead. If that happens, I am more than happy to subscribe to new discounted bank shares.

So, what did I do after Singapore's Phase 2 re-opening of the economy? Satisfy my hotpot craving of course! ^^

If you want to see the sunshine, you have to weather the storm

Dividend Warrior