|

| (Total cumulative dividends: S$241, 507) |

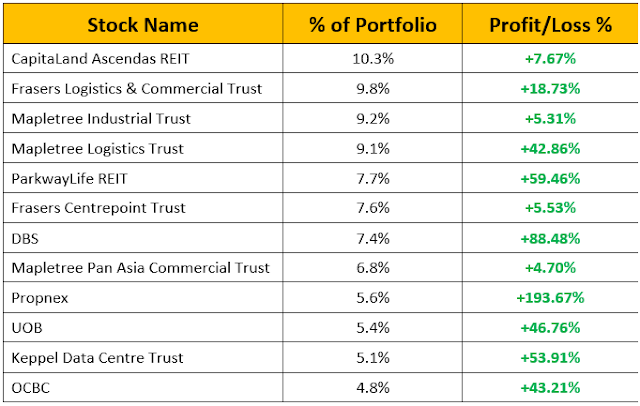

Portfolio Cost: S$547, 093

Portfolio Market Value: S$679, 301

Portfolio Overall Unrealized Profit: +S$132, 208 (+24.17%)

Portfolio XIRR (FY2022): -13.06% (inclusive of dividends)

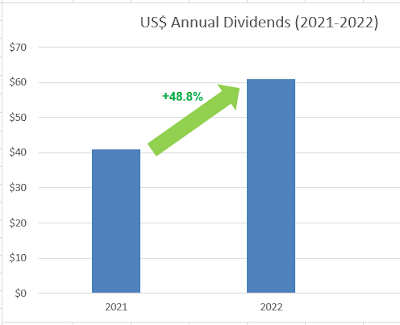

Dividends Collected (FY2022): S$34, 712 + US$61

Total Cumulative Dividends (2010-2022): S$241, 507

Current Cash Warchest: S$17, 000

(*All figures are accurate as of 30 Dec 2022)

Portfolio Actions in Q4 2022:

- Accumulated more Baba (9988) at HK$83

- Accumulated more Apple at US$130

- Accumulated more Microsoft at US$238

- Accumulated more Tesla at US$160

- Accumulated more Frasers Commercial & Logistics Trust at S$1.10

- Accumulated more Mapletree Industrial Trust at S$2.15

- Accumulated more Mapletree Pan Asia Commercial Trust at S$1.65

Looking Back at 2022...

The US Fed rate hikes have exerted downward pressure on REITs throughout 2022. Fortunately, higher rates is positive for the banks' NIM. As I also have significant positions in the three local banks, the rise in the banks' share prices helped to mitigate the decline in REITs. Even though my portfolio's market value declined 11% year-on-year, my annual dividends finally broke the S$30k milestone in 2022! Every cloud has a silver lining, right? The year started off in the most horrific way possible with Putin launching an invasion on Ukraine. The war dominated international headlines in the first half of 2022. This was followed by the covid lockdown in Shanghai. The focus of the second half of 2022 was dominated by rising inflation, aggressive Fed rate hikes and a crypto bubble burst.

Not expecting 2023 to be any better.... or worse. In my opinion, the war would probably drag on with neither side willing to compromise, inflation remains sticky, the Fed keeping rates high for an extended period of time and crypto remains out of favour. The only potential bright spot is the re-opening of China. But one could argue that a booming Chinese economy could worsen the global inflation.

Lessons Learnt in 2022

The legendary investor Charlie Munger once said that he wants to know where he is going to die so he will never go there. Prevention is better than the cure. One of the best ways to learn is to observe mistakes made by others. This will help us avoid some of the major pitfalls. If we can learn lessons the easy way, why do it the hard way? These investing blunders sure looks obvious now, but only in hindsight. The year 2022 was full of lessons. Even a sovereign wealth fund like Temasek could fall prey to Sam Bankman Fried’s FTX fraud! Well, let’s take a look at the simple but important lessons I learnt in 2022.

Never go all-in even if you have high conviction. Always leave some dry powder. Maintain a warchest for opportunities if the market keeps dropping. Space out the buying in tranches or some would say dollar-cost-averaging.

Never use margin/leverage if you are just a normal retail investor (majority of the population). Don’t overestimate your investing abilities. The market can stay irrational longer than you can stay solvent. And in the case of Chinese tech stocks, the CCP can stay irrational and strong-handed longer than you can stay solvent.

Never put all your chips on one stock/asset no matter how strong your conviction is. A healthy level of diversification is essential for an average Joe who is investing for the long-term. Of course, don’t over-diversify by buying 50 stocks.

Triple jeopardy! Never ever go all-in, using margin, on a single stock/asset. This is just asking for trouble. Risk management 101. There are people who did this for Tesla, Alibaba and even crypto. One of my friends, who is an experienced investor made this mistake on Alibaba. In the end, he was forced to sell a huge chunk of his Baba (9988) position due to margin call below HK$70.

Plans & Targets For 2023

- Reinvest dividends by accumulating Banks, REITs and Big Tech. The compounding of dividends never stops. Bearish market sentiments have always helped me grow my dividend portfolio as it is easier to buy stocks on the cheap.

- Achieve S$36, 000 in annual dividends

- Continue to top-up my CPF MA and SA

- Key collection for my new BTO flat and home renovations (Yes! Finally!)

- Maintain my current fitness programme. Alternating between cardio, jogging & weightlifting.

- Enjoy good food at the malls I am vested in! :P

No comments:

Post a Comment