|

| 2018 Annual report of DBS & the electronic voting device |

Growth Drivers:

- The wealth management business grew 5 times and the cash management business expanded 8 times over the last decade. Both formed around one-third of the bank's total income. Their growth rate is encouraging/important because they are considered 'high-returns' businesses, which are less capital-intensive.

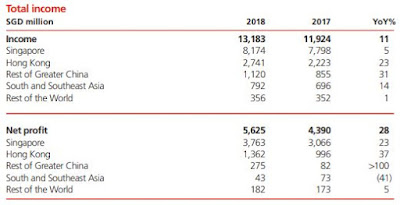

- Achieved significant income growth from the Hong Kong & China markets. This shows that the acquisition of Dao Heng Bank years ago, has paid off. Prosperity of HK is closely tied to the fortunes of China. The CEPA between China & HK would benefit DBS in the long run

- The ASEAN-HK FTA signed in 2017 has started to take effect on the real economy as the trade infrastructure & business networks ramp up progressively. It should continue to drive economic growth in the region. This is advantageous to DBS as the bank has significant presence in SEA countries like Vietnam & Indonesia.

- The consumer/wealth management segment achieved 21% income growth. Attributed largely to the acquisition of ANZ's wealth management & retail banking businesses in 2017. DBS was able to extract value out of this acquisition with a focus on maximising profits while keeping costs under control. This is reflected in the bank's cost-income ratio since 2015. The cost-income ratio has come down and remained steady.

- Launched a wholly-owned subsidiary in India, which already started in March 2019. Looking to open more branches in India.

- DBS is not only acquiring more digital customers but also better-quality customers. The ROE from digital customer base is better than traditional customers.

- DBS has formed plenty of partnerships with a wide range of digital platforms such as GoJek. The number of digitally-acquired individuals and SMEs have been rising steadily. This shows that the bank is making good progress in transitioning to digital acquisition of customers. This is important for future growth because this is a low-cost, manpower-light method.

Risk-Management & Challenges Ahead:

- One shareholder is concerned about the sustainability of the current generous dividend payout in the event of an economic slowdown. The CEO replied that the bank focuses on stable, sustainable dividends in terms of the 'absolute amount' paid out. Current payout ratio is considered 'comfortable'. Confident of maintaining the current $1.20 per share annual dividends. The payout ratio might fluctuate a little from year to year, but the bank is confident that its current operations is able to support the 'absolute amount of dividends'.

- One shareholder is worried that NPLs from China's clients might spike up if the US-China trade war drags on this year. The CEO replied that DBS has always focused on working with big, stronger companies in China. Their domestic financing needs can be met by the major Chinese banks. But when they want to expand into overseas markets, they require the services of a reputable foreign bank like DBS to help them with international trade finance. DBS is very selective when doing business with mainland China clients. The bank performs lots of stress-testing before committing to loans. Even if the clients are forced to shift their production & supply chains out of China, they are going to countries like Thailand & Vietnam where DBS also operates in. So, it is possible that DBS can still participate in their growth. The bank has a specific committee that looks closely and assess credit risks on their loan portfolio. They are very conservative/careful in this aspect.

- One shareholder voiced his concerns about potential disruption from Fintech. The CEO replied that re-positioning DBS into a digital bank is how it guards against disruption. He believes that banks which can disrupt themselves and adapt quickly enough, will survive.

- One shareholder was worried that a dovish US Fed & a flat yield curve would affect DBS's NIM profits this year. The CEO replied that global GDP growth has indeed slowed down. This is likely the start of a synchronized slowdown. Even though there is some co-relation between the rates in Asia and the US Fed rates, the effect is not immediate. There is a lag and the co-relation is not exactly 1:1. Due to this 'delay' effect, he still expects to see healthy NIM this year despite the Fed rate hike pause.

- A shareholder voiced his concerns about DBS's role in the Hyflux perpetual bond default. He is wondering if DBS's analysts lack the 'foresight' on Hyflux's financial problems. The CEO assured the shareholders that DBS has done all the required due diligence and followed all the rules & regulations set by MAS. Although what happened to Hyflux is unfortunate, the analysts could only make their best educated 'judgement call' based on the data provided by Hyflux at that specific period of time. Nobody expects things to deteriorate so badly at Hyflux.

No comments:

Post a Comment