|

| (Total cumulative dividends: S$249, 321) |

Portfolio Cost: S$589, 075

Portfolio Market Value: S$740, 355

Portfolio Overall Unrealized Profit: +S$151, 280 (+25.68%)

Portfolio XIRR (Q1 2023): +12.14% (inclusive of dividends)

Dividends Collected (Q1 2023): S$7, 814 (+43% yoy)

Total Cumulative Dividends (2010 - Q1 2023): S$249, 321

Current Cash Warchest: S$36, 723

(*All figures are accurate as of 31 Mar 2023)

Portfolio Actions in Q1 2023:

- Accumulated OCBC at S$12.30

- Accumulated UOB at S$28.90

- Accumulated Mapletree Industrial Trust at S$2.33

Long-Term Compounding On Solid Dividend Payers

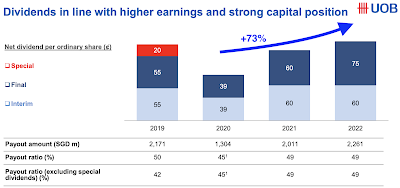

In Q1 2023, the three local banks raised their dividend payouts. DBS is the leader in this respect by paying out a hefty special dividend. This helps to boost my Q1 2023 dividends by 43% year-on-year compared to Q1 2022. On track to exceed S$38k in annual dividends. Alibaba, US Big Tech and blue-chip REITs staged a late rally towards the end of March, thus boosting my portfolio YTD returns into positive territory.

In Q1 2023, the three local banks raised their dividend payouts. DBS is the leader in this respect by paying out a hefty special dividend. This helps to boost my Q1 2023 dividends by 43% year-on-year compared to Q1 2022. On track to exceed S$38k in annual dividends. Alibaba, US Big Tech and blue-chip REITs staged a late rally towards the end of March, thus boosting my portfolio YTD returns into positive territory.

The recent banking crisis in the US & EU sparked fears of financial contagion. Almost everyone was shouting about an impending market crash similar to GFC 2008/2009. Experts were saying the sudden collapse of Silicon Valley Bank & Credit Suisse was the first domino to fall. More bank failures are coming, this is another ‘Lehman Brothers’ moment they said!

Well, long-time readers of my blog would know what I tend to do in turbulent times like these. I did what I do best. I invoked my warrior spirit and bought the dip. Nibbled some OCBC, UOB and Mapletree Industrial Trust. The compounding of quality dividend stocks never stops. How does Dividend Warrior stay unfazed and calm during a market turmoil? You can refer to my old post here.

Did Not Follow The Flight To Safety

When others were rushing into fixed deposits, T-bills and Singapore Savings Bonds, I was busy accumulating more solid dividend payers. I believe dividend growth investing has a better potential of generating more cash-flow over the long run. I am not an old retiree in his 60s or 70s. Time is still on my side. So I can still afford to weather the storm and reap the rewards much later. No need to go into capital-preservation mode yet. These fixed income assets are not going to help me beat high inflation. Besides, my substantial CPF savings already formed the fixed income component of my portfolio.

Some people told me that they are just ‘parking’ their funds in fixed-income instrument for the short-term. Once their T-bills and fixed deposits mature, they can deploy the funds back into the market. Sure, they could get their timing absolutely right. Or horribly wrong. Maybe by the time they get their funds, the market already rallied way beyond their expectations. The boat left and they got stuck at the port. After merely one week, the banking system seems to have stabilised. Investors are already moving onto the next theme in the news cycle, which is the Fed pivot. This time last year, I remember everyone was super focused on the Russia-Ukraine war. After a year, nobody really cares about that anymore. This goes to show that time in market is always better than timing the market for long-term investors.

I prefer to focus on the things within my control. Stop wasting time and energy worrying about things that are out of our control. And this is a habit. You don’t become what you want. You become what your habits take you. The harder the battles, the sweeter the victory. A lot of people have this ‘wait and see’ mentality. Wait for the banking crisis to pass. Wait for the Fed to pivot. Wait for inflation to come down. Wait, wait, wait. They take no concrete actions towards their goals. They procrastinate. They wait along the sidelines. Sometimes we just have to go for it! Get our hands dirty. Get our feet wet. This is how we grow.

BTFD Still Works Thanks To Swift Bailouts

Even the usually bearish Michael Burry has respect for our generation. The generation of BTFD. In my opinion, BTFD works for the current generation of investors because the top policymakers currently running the US Federal Reserve still have PTSD of the 2008 GFC. Decision-makers like Jerome Powell and Janet Yellen are haunted by the collapse of Lehman Brothers and the near collapse of AIG. Banks are simply still too big to fail.

Back then, the world was on the brink of a new Great Depression. There is no way in hell these veterans would allow that to happen again. Moral hazard be damned. So, when the latest bank run crisis unfolded, they acted swiftly with a heavy hand to squash contagion risks. Jerome Powell even had to lower the March rate hike from 50bps to 25bps. He expects credit-tightening to taper inflation in the coming months. The Swiss regulators also engineered a swift rescue of Credit Suisse in one weekend. They basically ‘force fed’ Credit Suisse to UBS. As a result, the market dips tend to be short-lived nowadays. I think it would take another generation before most people truly forget about the horrors of 2008/2009.

Lean On The Capable & Rich

I know my own limitations and capabilities, so I stay within my circle of competency. Let the management get on with their job and stay out of their way. Let the experts work their magic. Sit back, relax and watch the cash flow in. Benefit from the spending of others. Every time someone spends at a mall or shops online, I benefit indirectly because I am vested in retail and logistics REITs. Every time a property agent closes a deal, I get to benefit through PropNex. Every time a private doctor bills a wealthy patient at Mount Elizabeth hospital, I benefit through ParkwayLife REIT (PLife). The retrofitting and major renovations (Project Renaissance) at Mount Elizabeth are scheduled for completion by 2025. It will benefit from a huge rent step-up of 25.3% in 2026 after the completion of Project Renaissance. Use the economy as your personal ATM. An ATM that keeps on giving you cash.

Lean On The Capable & Rich

I know my own limitations and capabilities, so I stay within my circle of competency. Let the management get on with their job and stay out of their way. Let the experts work their magic. Sit back, relax and watch the cash flow in. Benefit from the spending of others. Every time someone spends at a mall or shops online, I benefit indirectly because I am vested in retail and logistics REITs. Every time a property agent closes a deal, I get to benefit through PropNex. Every time a private doctor bills a wealthy patient at Mount Elizabeth hospital, I benefit through ParkwayLife REIT (PLife). The retrofitting and major renovations (Project Renaissance) at Mount Elizabeth are scheduled for completion by 2025. It will benefit from a huge rent step-up of 25.3% in 2026 after the completion of Project Renaissance. Use the economy as your personal ATM. An ATM that keeps on giving you cash.

Achieve FIRE on dividends. Take advantage of the capitalistic system. Cash flowing into your pockets as you sleep. I see people complaining about ‘evil’ landlords charging higher rentals. Don’t fight them, join them. Complaining will never get you anywhere near your goals. Instead, you should own a piece of the economic pie. Have your meals, bills and vacations ‘sponsored’ by dividends.

Attractiveness Of Dividend Growth Investing

I give myself a pay raise every year. How? By investing in high quality dividend stocks. Imagine walking into your 9-5 job every morning, knowing that your passive income can cover your living expenses and more. That is the secret financial power I want to enjoy. There was a day when I was chilling at Starbucks with my dark mocha frappe after lunch. Logged into my bank account to see more than $1k dividends credited. It was a lovely feeling! As my dividend cashflow increases, my quality of life also improves. Finally completed my Apple ecosystem with the purchase of the MacBook Air and Airpods Pro!

No comments:

Post a Comment