|

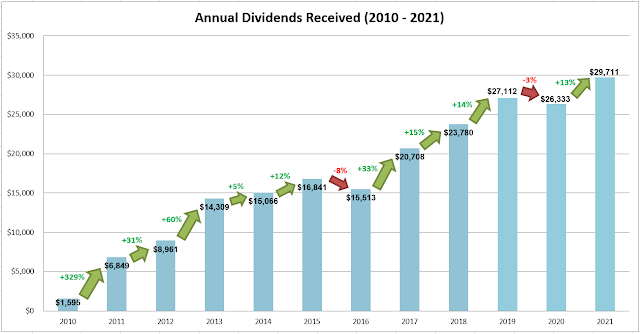

| (Total Cumulative Dividends of S$206, 778) |

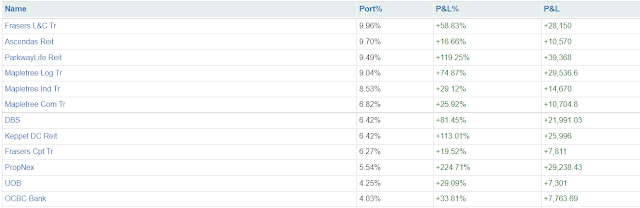

Portfolio Cost: S$535, 682

Portfolio Market Value: S$762, 835

Portfolio Overall Unrealized Profit: +S$227, 152 (+42.4%)

Portfolio XIRR (FY2021): +10.34%

Dividends Collected (FY2021): S$29, 711

Total Cumulative Dividends (2010-2021): S$206, 778

Current Cash Warchest: S$16, 300

(*All figures are accurate as of 31 Dec 2021)

Portfolio Actions in Q4 2021:

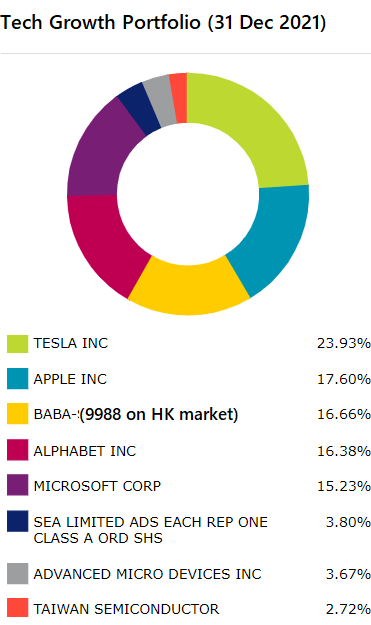

- Initiated new position on Alphabet (GOOG) at US$2859

- Accumulated more CLCT at S$1.20 and S$1.17

- Accumulated more MINT at S$2.78 and S$2.66

- Accumulated more Apple at US$158

- Accumulated more Tesla at US$1008, US$985, US$958 and US$938

- Accumulated more Sea Ltd at US$300

- Divested Baba on the US market at US$127, taking a -45% loss

(*Still holding onto my Baba 9988 on the Hong Kong market)

- Divested VICOM at S$2.05, taking a -2.8% loss

- Divested Venture at S$19.30, taking a -6.3% loss

- Divested HST ETF at S$1.076, taking a -20.9% loss

Milestones Achieved:

- Portfolio value crossed the S$700k mark in Q1 2021

- Record high annual dividends of S$29, 711

- Personal Net Worth crossed S$900k mark in Q2 2021

Cutting The Weeds & Planting New Seeds

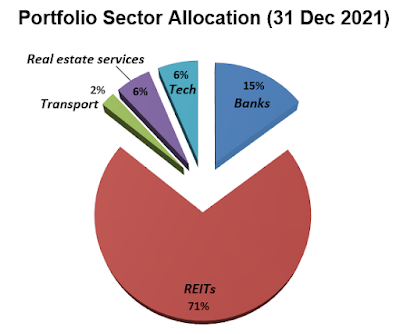

Did a tonne of rebalancing work on my portfolio in Q4. Cutting away all my tiny, loss-making positions and reinvest into the winners. Cutting away the festering tumors so that healthy cells can grow again. At the very least, my portfolio growth was able to offset the high inflation. 10.34% XIRR and 13% annual dividend growth is nothing to write home about, but I can live with that, considering there are people still mired in losses in a bullish year.

If there is one thing I learnt in 2021, that is to stay with the winners. Take Apple and Tesla as examples. Considering their size, both companies achieved phenomenal consistent growth in 2021. Especially for Tesla, the EV tidal wave looks unstoppable. I believe 2022 is going to be an explosive year for Tesla. Giga Berlin and Giga Texas starting production, 4680 cells high-volume production, Giga Shanghai expansion, FSD Beta 11 going to Level 4 autonomy, automotive insurance and Cybertruck production.

Tesla is in a sweet spot now. In 2021, they already showed how a ramped-up Giga Shanghai can boost earnings sustainably. With two new Gigafactories on the verge of production, Tesla is going to further strengthen its track record of growing earnings and net income. It should get more profitable as the gross margins expand. Tesla is able to squeeze more profits out of each EV than the legacy automakers. The Gigafactories are more efficient and vertically integrated than those old factories of legacy car companies. This is like taking a leaf out of Apple's playbook. Its iPhone global market share is only 12%, way below Samsung's. But Apple is taking around 40% of the global smartphone profits! All about that profit margin.Although 2021 was the first year I got into the tech sector, it turned out that investing in tech stocks is rather similar to investing in bluechips and REITs. Always go for the Top Dogs. Big Tech usually stay long-term winners as they compound on their competitive advantages and dominant market position. Winner takes all. The returns of S&P500 and Nasdaq in recent years have been heavily skewed towards the top 6 constituents (FAAMG). Apple with its iPhone and Mac eco-system, Alphabet with its Google search engine and Youtube, Microsoft with its Windows, Office software and Azure cloud services. As we enter the new rate hike cycle, investors are shifting to companies with proven revenue AND earnings growth. Those cash-burning small companies are falling out of favour. Selling a beautiful growth story of producing actual earnings far into the future doesn't seem that attractive anymore.

General Strategy For 2022

Similar to 2021, I would adopt a Barbell approach in 2022. Go defensive with CPF top-ups and REITs. Go offensive on Tech with profitable growth. I am targeting to hit S$800k in portfolio value and $33k in annual dividends. Alright then, so much for all the heavy investment stuff. >_< We must not forget to reward ourselves occasionally. Can't bring all that wealth to the grave! Enjoy your favourite food. Buy a little something for yourself. Sometimes, it is more productive to slow down and reflect. I do some of my best thinking when I am taking a stroll. Getting close to nature is one of my new year resolutions.

No comments:

Post a Comment